If you were left the property or if you co-owned the property with the deceased youll have a good chance of being awarded the property when the estates assets are distributed. Therefore in our example if your heirs sold the stock for 110000 after your death they would pay capital gains tax on 109000 rather than 10000.

Letter For My Father In Heaven Letter To My Dad Dad In Heaven Dad In Heaven Quotes

Also known as a beneficiary deed this type of deed lets you inherit the property directly and immediately without the time hassle and expense of probate.

How do i put my deceased parents house in my name. Usually you receive a stepped up basis in the property and when sold little or no gain will taxable. The title would be transferred to the name of the heir chosen. With this type of deed in place you can proceed with the sale of your parents home as soon.

If the property is in your friends moms name your friend might need to take a couple of steps before she can sell the homeWhile your friend might be her moms sole heir your friend. When a house is involved it may be sold to divide the profit between the heirs or the will may have stipulated that one heir gets the house. Jones my mother and father both passed away last year.

More commonly however the property will be included as part of the persons estate. At the end of this time the executor of your mothers estate who is the person she named in her will to oversee the distribution of her assets will create and record a deed to change title of her home into the name of the beneficiary who is to receive it. During probate the estates assets will be divided according to a will and state laws.

How the transfer of a house to an heir is handled changes when there is a mortgage on the property. Gainloss will be computed once you enter the fair market value of the home on the date the deceased passed away. You will enter the sale of an inherited home in the Investment section.

You will need to. To forward the deceaseds mail to yourself or to a different address you must file a request at your local Post Office. This isnt a sure thing in all states however particularly if the will was created without the benefit of legal advice.

I am sorry for your loss. Find a Post Office. If the deceased died intestate -- without a will -- state law takes over.

Child owns 100 upon death of parent. As such they could have to pay ten-times more taxes to inherit the same property. Germain Depository Institutions Act of 1982 prohibits enforcement of a due-on-sale clause after specific kinds of transactions like a property transfer to a relative upon the borrowers death or a transfer from a parent to child.

Transfer by deed to child and parent as joint owners with rights of survivorship. The result will be a document known as a judgment of possession. They were living mostly on Social Security and didnt have much except their small house that was bought and paid for.

Many people think it is a good idea to put their childs name on the deed to their home especially if one of the parents is deceased. Provide valid proof that you are the appointed executor or administrator authorized to manage the deceaseds mail. Whoever the will names as the beneficiary to the house inherits it which requires filing a new deed confirming her title.

Your insurance company will then see that you have an insurable interest in the property. You will need to have an attorney prepare and file a succession for your mothers estate. You did not own jointly own the property with the deceased owner while the deceased owner was alive but the deceased owner named you to inherit the property through a life estate deed TOD or beneficiary deed or lady bird deed.

But the federal Garn-St. In some states the spouse shares the estate with the children of the deceased. 85000 FMV at date of deceased passage 85000 no gain.

Complete a Forwarding Change of Address order at the Post Office. File an Affidavit of Death form an original certified death certificate executor approval for the transfer a Preliminary Change of Ownership Report form and a transfer tax affidavit. If the mother included the property as part of a living trust title will pass on through an informal process.

Generally a special warranty deed is filed to transfer real property. This may depend on whether the children are issue of a prior relationship. If the house was held in joint tenancy then you need to file an affidavit of death of a joint tenant.

If there are also no children parents and then siblings stand to. Each state has guidelines for who inherits after someone dies intestate but its generally the closest surviving relatives such as a spouse or children. That will clear your parents.

My sister lives in Florida so we. This can be filed with the County records office. Whether or not youd get property in your name upon the death of a parent depends on the will.

When there is no surviving spouse the children are the primary heirs. Dont transfer your late parents house title to your name. My sister and I are their only children and heirs.

Adding a childs name to property usually deprives them of the ability to qualify for a stepped-up tax basis. When a House Has a Mortgage. It depends on how the title to their house was held at the time that they died.

There is one way for the ownership of your deceased parents home to transfer to you as easily as it does in the movies. Transfer by trust to child after death. Typically the primary heir is the persons spouse.

Usually the motivation is to avoid inheritance tax and probate or to prevent the family home from being sold to pay for nursing home expenses. Transfer by deed while living but allow parent to live in and sell while living Lady Bird Deed. In estates where both parents are deceased and a home remains in their name there is most likely a need for some type of formal probate of their estates in order to transfer title of the parents real property to either the heirs if no will or beneficiaries if they had a will or some combination of the two.

Transfer by will to child after death. The transfer on death deed.

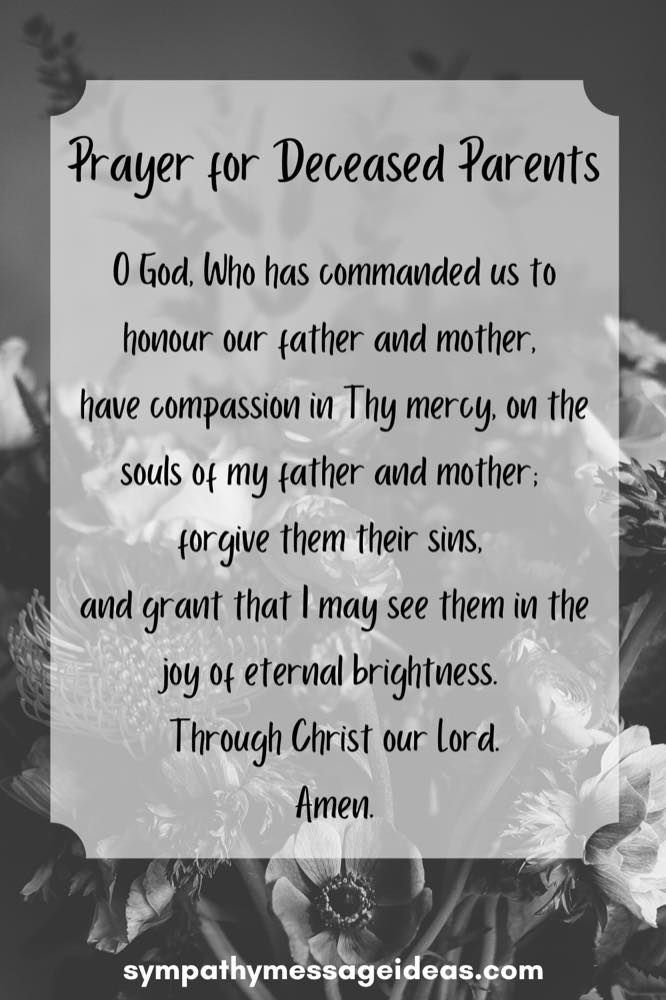

18 Prayers For The Dead Catholic Christian Prayers For Loss Sympathy Card Messages

Wild About Words Family Literacy Night School Family Night Ideas Literacy Night

We Know How To Do It On Twitter Grief Quotes Grieving Quotes Goodbye Poem

A Photo Table Is A Great Way To Honor Deceased Loved Ones At Your Wedding Wedding Memorial Dream Wedding Wedding Wishes

45 Missing Parents Who Passed Away Quotes The Random Vibez

Scout Lives In Maycomb With Her Father Atticus Finch And Her Brother Jem Her Mother Died Of Heart Attack Wh To Kill A Mockingbird Atticus Finch Media Literacy

Mothers In Heaven Mom In Heaven Quotes Mom In Heaven Missing Mom Quotes

Pin By Andrew Doxey On A Song Of Ice And Fire Game Of Thrones Funny Game Of Thrones Meme Game Of Thrones Mbti

Pin By Clarissa Petri On Thinking Outloud Miss You Mom Quotes Grief Quotes

18 Prayers For The Dead Catholic Christian Prayers For Loss Sympathy Card Messages

Unique Wedding Memorial Ideas In Loving Memory Diys Wedding Memorial Dream Wedding Wedding

Miss You Dad Miss You Daddy Remembering Dad Fathers Day Quotes

Possible Owner Financing Old Houses Old Houses For Sale Fixer Upper

Checklist What To Do When A Loved One Dies Edwards Group Llc Funeral Planning Checklist Funeral Planning Funeral Checklist

Remembrance Photo Add Deceased Loved One To Photo Picture Of Deceased Guardian Angel Deceased Grandpa Deceased Grandma Gift For Loss Ghost Photo Editing Services Ghost Photos Photo

Memorial Tributes To Mothers Lovetoknow Writing A Eulogy Eulogy For Mom Eulogy Examples